How to negotiate an offer on your listing

| Share to |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reply with Video | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

BC Government announces "New Speculation Tax" details

To help make housing in overheated markets more affordable and available, the B.C. government is targeting property speculators, while making sure that over 99% of British Columbians will not pay the speculation tax.

Carole James, Minister of Finance, made the announcement while releasing details of the new tax on speculators, which was announced in the February budget.

“Our government wants to make sure people who live and work here are able to find and afford a good home in their community,” said James. “For too long, this housing crisis was allowed to escalate, and it has hurt working families, renters, students, seniors and others around the province. With this new tax, we’re targeting speculation in the housing market and freeing up vacant housing to be homes for British Columbians.”

The tax details released today contain a series of thresholds, exemptions and geographic refinements that serve to focus their reach on people who own multiple homes left empty in overheated markets, while making sure that British Columbians who own vacation properties are largely exempted.

“The speculation tax focuses on people who are treating our housing market like a stock market,” said James. “So people in smaller communities, those with cottages at the lake or on the islands, will not pay this tax. People with second homes outside of high-cost, designated urban areas will not pay the tax. We are going after speculators who are clearly taking advantage of the market, leaving homes vacant and driving up prices.”

At the heart of the tax details are:

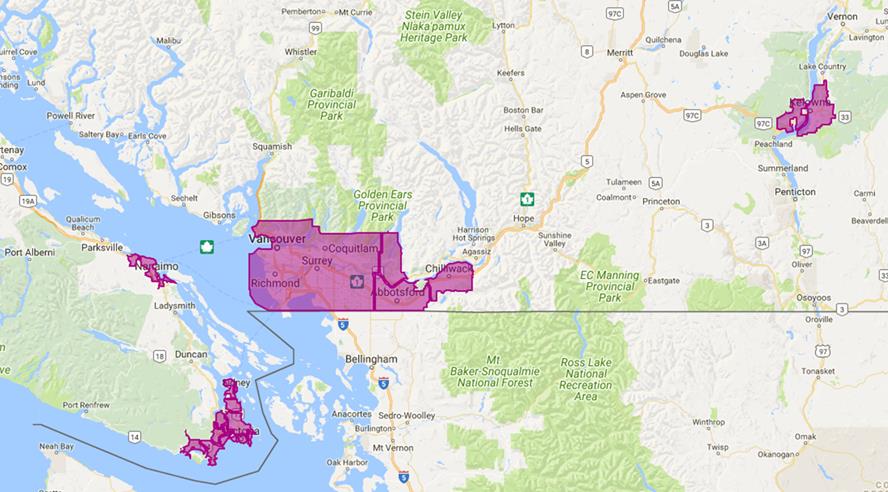

- A highly refined set of geographic areas in which the tax will apply, defined as: Metro Vancouver, the Capital Regional District (excluding the Gulf Islands and Juan de Fuca), Kelowna, West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack and Mission.

- Details on the exemptions for British Columbians’ primary residences and for qualifying long-term rentals.

- A rate design that will see British Columbians who are subject to the tax, paying lower rates than owners from outside the province in 2019 and beyond. Canadians from other provinces will have a rate of 1% in 2019 and beyond, while foreign investors and satellite families will pay a 2% rate.

“We have focused the geographic areas so this tax only applies in urban housing markets hardest hit by this crisis,” said James. “With so many people desperate to find good homes in these urban areas, we need to take every step we can to free up and create more housing opportunities.”

Additional details of the speculation tax include:

Geographic areas

On implementation, the speculation tax will apply to:

- Metro Vancouver

- The Capital Regional District (excluding the Gulf Islands and Juan de Fuca)

- Kelowna and West Kelowna

- Nanaimo-Lantzville

- Abbotsford, Chilliwack and Mission

Rate design

In 2018, the tax rate for all properties subject to the tax is 0.5% of the property value.

In 2019 and subsequent years, the tax rates will be as follows:

- 2% for foreign investors and satellite families;

- 1% for Canadian citizens and permanent residents who do not live in British Columbia; and

- 0.5% for British Columbians who are Canadian citizens or permanent residents (and not members of a satellite family).

Exemptions and tax credit design

There are exemptions for British Columbians’ primary residences and for qualifying long-term rentals.

British Columbians with vacant second homes will be eligible for a non-refundable tax credit that is immediately applied against the speculation tax. This credit will offset a total of $2,000 in speculation tax payable. This tax credit will ensure that British Columbians do not pay tax on a second home valued up to $400,000.

Definition of long-term rentals

A long-term rental is a property that is rented out for at least six months out of the calendar year in increments of at least 30 days. In 2018, a long-term rental is a property that is rented out for three months of that year.

Special case exemptions

As announced in Budget 2018, there will be exemptions for homeowners facing special circumstances. These include:

- The owner or tenant is undergoing medical care or residing in a hospital, long-term care or a supportive-care facility.

- The owner or tenant is temporarily absent for work purposes.

- The registered owner is deceased, and the estate is in the process of being administered.

Quick Facts:

- The speculation tax was announced as part of Budget 2018.

- The B.C. government will introduce legislation this fall to enact the tax.

- Over 99% of British Columbians are estimated to be exempt from the tax.

Sweden house prices on the rise too........

http://ca.reuters.com/article/idCAKCN0SQ1L320151101?sp=true.

Have a look at this article where Sweden is experiencing many of the same issues we are here in Canada. Specifically, what Vancouver's Real Estate Market is experiencing.

It's not just Vancouver whose Real Estate market has taken off to new dizzying heights. Downtown Vancouver still seems to be ahead of Stockholm and London though.

Hooray for us?

Anybody have a comment?

Demand more from builders!

In our frenzied market where people are lining up for the "privelage" of buying a new home, builders are getting away with delivering old style renovations that do not take advantage of modern building technology. If you are claiming to be selling a renovated house as 'good as a new home,' then where are the modern advances in technology?

Like, for example, energy efficiency (http://www.bchydro.com/powersmart/residential/buying-a-home/features-energy-efficient-home.html.), sound and fire insulation, breathable homes, recycled building materials.

So many builders and renovators (flippers) are earning premium prices for average quality, so why don't they deliver a premium product?

Being able to recognize the difference between a quality renovation and "lipstick on a pig" is one of the biggest reasons having an experienced Realtor working for you is so very important.

I have that experience and I am always happy to help you, your friends and your family with all of your Real Estate needs and questions.

Scotiabank refinance promotion

This morning I received a call from Andrew Wright (wright@mortgagegrp.com) a great, hard working Mortgage Broker who provides great service to many of my clients. He informed me of a great offer from Scotiabank to pay for appraisal and (some) legal fees at a rate of PRIME - 0.6%. This is a good opportunity for anyone interested in accessing their home's equity, consolidate debts or just get a lower interest rate on their mortgage. Contact Andrew at his email address or phone him directly at the number below:

The Prompton Real Estate Services Inc. real estate kiosk and information centre is now open in Yaletown!

The kiosk is located between Urban Fare and Starbucks, on Davie Street, near Marinaside Crescent. This fabulous, high-traffic, location makes it easy for local residents to drop by and ask questions about the market, new developments, recent salesin their buildings, and any other questions they may have. The REALTOR on duty will also be available to provide information about the neighbourhood, give directions, offer recommendations, etc. to both locals and visitors to Vancouver.

This is just one more Prompton advantage that gives our listings more exposure to potential buyers! Prompton listings will have professional photos featured on the 80" wall-mounted TV that runs 24-hours per day.

CMHC reports that Sellers are withdrawing their homes from the market rather than accept lower prices

In its January 2013 report on the Vanouver-Abbotsford Census Market Area (CMA) CMHC that despite the fact that the market swung towards buyers through the last half of 2012, selling price drops were less than would have otherwise been expected. CMHC posits that this result may be explained by the phenomenon of Sellers withdrawing their properties from the market rather than accepting lower prices. The report also notes that statistics can become skewed by outlying values. I have always believed that news reports and statistics should be only one aspect of a real estate evaluation and decision. What is true now more than ever is that markets for different property types behave very differently than the "average" property. This is where a Realtor's expertise and perspective is most important in helping you put property values in the proper perspective.

See Report: http://keithpulling.com/_media/Documents/Housing%20NOW%20-%20Vancouver%20-%20CMHC%20-%20January%202013.pdf.

What do you think? Write or call me any time.